Judith Hall, 87, has lived in her Seminole Heights home for 35 years.

Hall bought the 800-square-foot home for around $40,000, but she could sell it tomorrow for more than $200,000.

That’s according to the dozens of cash offers she receives every week from investors.

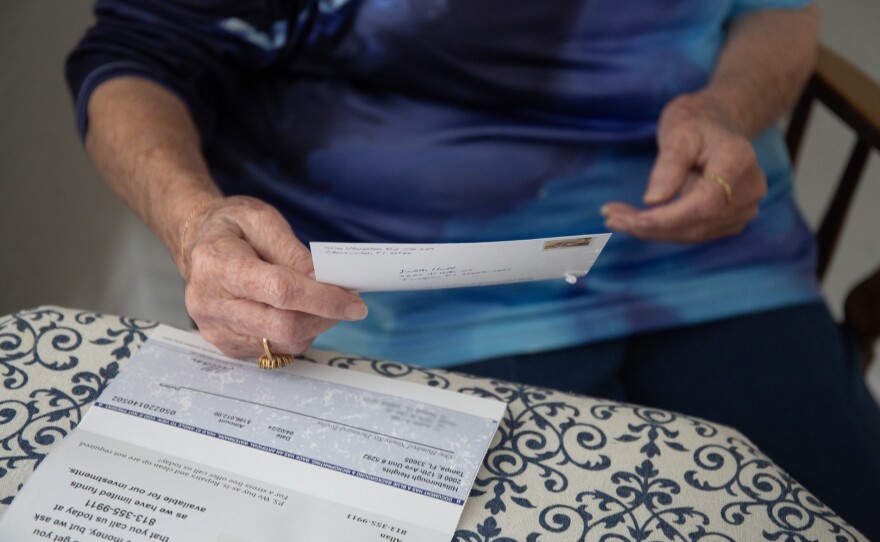

She sits at her kitchen counter and thumbs through a pile of mail.

“This one came yesterday. And it says, if you're ready to turn this into a live check, you know, call him,” she said. “And there's a check for $196,000.”

Hall said she’s not surprised by the investor interest in her home.

She has watched investor activity steadily climb in her neighborhood in recent years.

Growing investor interest

Investors, including individuals and corporations, are buying more single family homes in the greater Tampa Bay region.

They will often flip the homes and resell them or renovate them and rent them out. And in some cases, the homes are listed as Airbnbs, or short-term rentals.

In Hall’s neighborhood, she said it’s typical to see a single-story home double in size, or an older home demolished and replaced with a larger one.

They sell for a lot of money, too.

Hall said the homes often reappear on Zillow for around half a million dollars.

“It’s really a dramatic change,” she said. “But it causes some good things and some bad things.”

The good and the bad

Homeowners who live on streets with investor activity say it’s transforming their neighborhoods.

Hall said in some ways, investors are rejuvenating the neighborhood when they refurbish old homes that might otherwise sit empty.

She points out one property near her that had sat abandoned for as long as she can remember.

“It was wretched. It had been that way for years,” she said.

Now, there’s cars out front and Hall said she's glad to see people living there again.

But there’s downsides to the new development, too.

Hall, like many other homeowners, has seen her property value climb in recent years. Along with it, Hall said her property taxes and insurance rates have increased.

While Florida law offers tax exemptions to protect homeowners from jumps in property value, Hall worries about extra taxes she might incur if she completes a significant renovation.

She is also wary that the investor activity, and climbing property values, could eventually jeopardize the diversity and affordability of her neighborhood — and evetually the feel of her neighborhood.

Hillsborough County property appraiser Bob Henriquez said investor activity has less of an impact on property values in a neighborhood than many people think.

“There’s always this immediate fear from folks: ‘Oh somebody built this McMansion next to my modest home that I’ve been sitting in for many years…my taxes are going to go up commensurate with that,’” he said.

That is not the case, Henriquez said.

Unless the modest home becomes an outlier in the neighborhood — the last one on the block, surrounded by larger, more expensive homes — the property value won’t significantly increase for that area, he said.

Henriquez said that the property appraiser’s office doesn’t “chase prices.”

In fact, median property values purposefully lag behind median home prices, which are much more sensitive to the current housing market.

Par for the course

In a South Tampa neighborhood north of Gandy Boulevard, realtor Allie Paige checks out a house listed at $358,000. She works with investors in the greater Tampa Bay region to buy, manage and sell properties.

When Paige saw the home, it had been on the market for a few days.

"It looks like we have a lot of water damage that's coming from the ceiling…we have baseboards missing, we obviously have a mold issue. I'm sure there's termites. But that's par for the course.”

Despite the shape it was in, Paige said it sold for $305,000 in six days.

She said it's a prime investment property for a smaller investor, or an individual who owns less than 100 properties. That's because it needs significant work that an institutional investor isn't likely to do.

“Right now, what it needs is to be gutted and redone and rented out and held onto,” she said.

Paige estimates the property would need at least $100,000 in renovations. Then it could be listed as a single family rental for about $3,000 a month.

Alternatively, it could be torn down and a bigger home could be built on the lot.

Paige said an investor's strategy depends on many factors: assuming risk, financing options, available cash and home prices.

To be competitive, investors must find homes in unusual ways, too.

Finding motivated sellers

Unlike normal buyers, investors are interested in off-market listings, St. Petersburg foreclosure attorney David Miller said.

“Investors don't want competition. They want motivated sellers and they want to be the first ones to find them.”

They often look for homes that aren’t currently for sale – but might be in the near future.

In some cases, Miller said the strategy is to sniff out properties where homeowners are struggling financially.

"Investors are looking for blood in the water, right?” Miller said. “They're looking for a situation where somebody is not in a good position to negotiate."

He said it's common for investors to buy contact lists of homeowners who are behind on mortgage payments or property taxes. They will also comb through obituaries and monitor foreclosure case filings.

While exploitive models exist, Miller said there are also investors who work transparently and ethically. They will strike deals that help both parties.

“Usually, it's a number that makes sense for both sides, and people are happy, you know, but … not all investors are like that,” he said.

After working with foreclosure clients in the Tampa Bay region for 15 years, Miller said he has a short list of five local investors he trusts to connect with his clients.

Data from the Shimberg Center for Housing Studies at the University of Florida shows that holdings by corporate investors are concentrated in less expensive homes in the greater Tampa Bay region.

Corporations hold more investments in cheaper homes

The 2023 data shows the distribution of corporate-owned homes, by property value, in the following counties: Hernando, Hillsborough, Pasco, Polk and Pinellas.

While corporations own less than 10 percent of all single family homes in the area, they own a larger share of homes that are worth between $200,000 and $300,000.

People who live in neighborhoods with less expensive homes are seeing the biggest changes. But it’s also happening in more expensive neighborhoods where one or two affordable homes remain.

The feel of the neighborhood

In St. Petersburg's Crescent Heights, Rebecca Davis said the historic homes drew her to the neighborhood.

Her house is around 100 years old.

"I love the idea that we're here for a time and then one day we'll pass through and someone else will hopefully be here, and someone else after that."

Davis said friends and family of past owners have even stopped by to tell her about the memories they made in her home.

One couple was married in the backyard. Another started their family when they were living in the guest house.

"This house has a sense of permanence that is really comforting, and makes it feel like home," she said.

Their home stands in contrast to the new construction on their block. Some of it has been turned into rentals.

She said the investment activity isn't overbearing yet. Though it has led to more movement in and out of the neighborhood.

She wonders if her block will lose that special sense of history and community it had when she bought it.

Gabriella Paul covers the stories of people living paycheck to paycheck in the greater Tampa Bay region for WUSF. She's also a Report for America corps member. Here’s how you can share your story with her.